I saw this post over a year ago on a great, nerdy blog I read regularly, www.philosophicaleconomics.com. This is helpful to keep in mind as the market demonstrates volatility. It was originally titled: Why A 66% Crash Would Be Better than a 200% Melt-up

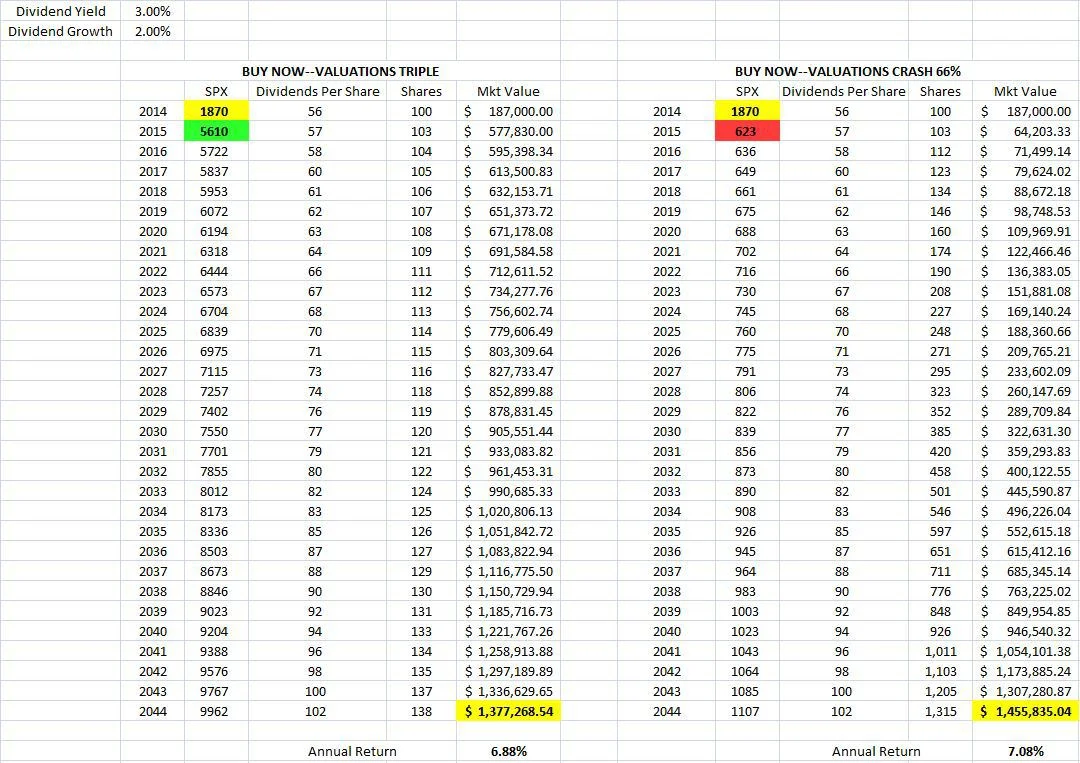

Suppose that you’re a middle-aged professional with a 30 year retirement time horizon. Your portfolio is 100% invested in U.S. equities–it consists of 100 shares of the S&P 500, worth $187K at current market prices. Assuming that the fundamentals remain unchanged, which outcome would leave you wealthier at retirement: (1) for the S&P 500 to soar 200% in a glorious bubble-like melt-up, or (2) for the S&P 500 to plunge 66% in a brutal Depression-like crash?

Surprisingly, you would end up wealthier at retirement if the plunge occurred. This is true even if we assume that the plunge lasts forever, and that you add no new money to the market as prices fall.

Let’s work through the details. We can separate the drivers of equity total return into three components: dividends, earnings per-share growth, and changes in valuation.

We’ll start with dividends. At 1870, the current S&P 500 dividend yield is somewhere between 1.8% and 2%. The reason it’s historically low is that a significant portion of the cash flow that has traditionally gone to dividends is currently going to share buybacks. But share buybacks are equivalent to dividends, reinvested internally. To make things simple, then, let’s assume that from here forward, all buyback cash flows are going to be diverted to dividends. From a total return perspective, the additional dividends will get reinvested by the shareholders, so everything will end up in the same place. If the current buyback yield, net of dilution, were diverted to dividends, the dividend yield would be something close to 3%, which, not coincidentally, is also what the dividend yield would be right now if the corporate sector adhered to a more historically normal dividend payout ratio.

Earnings per share (EPS) growth is more difficult to estimate because we don’t know what’s going to happen to corporate profitability–it’s currently at an elevated level and could revert to the mean. To be conservative, let’s assume that it does revert to the mean, and that EPS growth, excluding the float-shrink effects of buybacks, ends up being very low–say, 2% per year.

As for the market’s valuation, we’re comparing two different possibilities: first, that it rises by 200%, second, that it falls by 66% percent. In both cases, we’re assuming that the move sticks–that the valuation stays elevated or depressed forever.

The following table outlines the trajectory of the total return in the two cases.

As you can see, the plunge is demonstrably better for your retirement than the melt-up, with the obvious caveat that you have to maintain discipline and stick with the investment. If you panic and sell in response to the plunge, all bets are off.

Now, to be clear, we haven’t priced in the intangibles associated with melt-ups and crashes–specifically, the highly satisfying experience of watching investments appreciate, and the highly distressing experience of watching them crater, particularly when other people’s money is involved. If we’re taking those intangibles into account, then we should obviously prefer the melt-up. But on a raw return basis, the plunge wins.

The reason the plunge produces a better final outcome is that the valuation at which investors reinvest dividends–or, alternatively, the valuation at which corporations buy back shares, if they choose that route instead of the dividend route–has a powerful impact on long-term total returns, an impact that increases non-linearly as valuations fall to depressed extremes. In the case of the plunge, the dividends are reinvested at roughly 1/9 the valuation of the bubble. Over 30 years, the accumulated effect of the cheap reinvestment is enough to fully make up for the one-time impact of a 9 bagger increase in valuation.

Investors might want to reconsider whether or not a world without corrections and crashes would actually be a good thing for the long-term, particularly given the extent to which corporations are currently recycling their cash flows into dividends and buybacks. As far as future returns are concerned, such a world would come at a cost, even for those that are already comfortably in.