Insurance frequently comes up during the financial review process at Independent Financial Planning and as you should be able to guess by now, knowing what insurances to have and how much to have covered depends upon your unique situation. Everyone is different and therefore knowing yourself will help you know what coverage to have. Having said that, there are two fundamental questions an investor should keep in mind when considering insurance. What is the probability of the event potentially covered by this insurance and how much of an impact would it have on my quality of life? As a general rule, people should cover the events that would significantly deteriorate quality of life and have a low probability of happening.

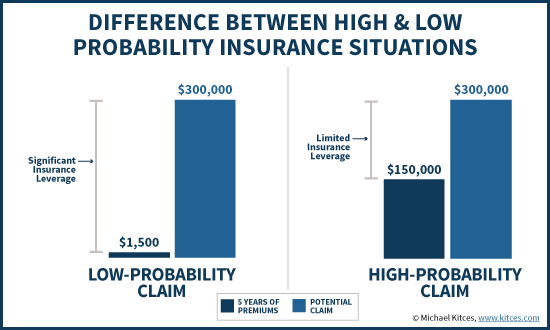

Insurance companies are not non-profit entities. They exist because they can spread the risk of a significant event across a diverse population and collect more in premium (and investment return on the premium) than what is paid out in claims. Anyone considering purchasing insurance should think, “I hope this never happens, but if it does happen I don't want to be in a situation where I have to pay for it.” Common examples include life insurance (covering death), homeowners insurance (covering damage to the home), and auto insurance (damage to a vehicle and liability for damaging another's person or property).

Think about each of the risks I mentioned above. Each one is unlikely, or in the event of death absolute (but unlikely during certain years in life) and would have a potentially serious impact on your quality of life. Meanwhile the costs associated with these events can extend into the hundreds of thousands of dollars. The risks for a 45-year-old male living to 95 is 11.4%, dying in the next five years is 0.62%, and losing a toe in an industrial accident less than 0.012% according to Moshe Milevsky author of Your Money Milestones (published in 2009). In some of those cases you could transfer risk by buying insurance, manage the risk by diversifying or changing jobs, or accept the risk as it is.

Insurances that generally an investor doesn't need are either higher probability events (which means you should save for them), or lower cost outcomes (no need for coverage). Think of the warranties on lower priced technological items. I was just at a local but ubiquitous hardware store to purchase a heat gun to melt glue while I was helping a friend remodel and as we were checking out the automated checkout machine (welcome to the 21st century) prompted me to buy a warranty on the item. I immediately declined. Why? Not because the item was of superior quality but because it was only $35. As it turned out the heat gun did have a problem and within three hours I as back at the store without the warranty and they took the broken one back and replaced it with a new one. The warranty, was not worth buying.

In later posts I will discuss some strategies for more effective insurances, like considering having higher deductibles. For now, keep this simple matrix in mind as you are considering insurances. Is it probable? Is it significant? I want you to make wise financial decisions and save and spend based on what is important to you. Let Independent Financial Planning help you do that.